How to Build a Financial Safety Net as a Squarespace Designer

Feel secure and confident about your income every month

Running your own business comes with risks. Once the initial excitement fades, you quickly realize there’s no steady paycheck arriving each month—you’re responsible for making enough to sustain yourself. On top of that, your income fluctuates, and the unpredictability can be stressful. But as a Squarespace designer, it is possible to build a business with consistent revenue and a financial safety net.

In this article, we’ll talk about how to create that stability and therefore reduce stress, approach your business with confidence, and avoid living paycheck to paycheck. The ultimate goal is to build something that not only supports you financially but also brings you joy and motivates you to keep moving forward.

Your Financial Foundation

The first step in building a financial safety net as a Squarespace designer—or any web designer—is understanding your budget. This means looking at both your personal and business finances to determine how much you actually need to cover expenses each month.

A common mistake is relying on your average monthly income. Let’s say, over the past few months, your earnings averaged $3,000. That might seem like a reasonable benchmark, but when you break it down, your income fluctuates—one month you made $2,000, another month $3,000, then $5,000, and back to $2,000. The question you need to ask yourself instead is: What’s your baseline?

Your baseline income is the amount you can confidently expect to make based on your current business operations and marketing efforts. In this example, that’s around $2,000—the lowest consistent amount you’ve earned. This number is the foundation of your financial planning. It helps you set realistic expectations, prepare for slow months, and build a safety net that keeps your business stable.

Building Stability: Increasing Your Baseline Income

Your goal isn’t just to average a certain income—it’s to increase your baseline so that, instead of inconsistent earnings, you’re making at least $3,000 (or whatever your target is) every single month.

But how do you make that happen? The first step is financial preparation, which means having an emergency fund. If your current baseline of $2,000 or even $3,000 isn’t enough to cover your personal and business expenses—including taxes—you need a financial cushion to bridge the gap. This fund acts as a safety net, subsidizing any shortfall during slow months so that you’re not scrambling to make ends meet.

If you're just starting out as a freelancer or transitioning to full-time self-employment, this might also mean keeping another source of income while you build that stability. Instead of quitting your job immediately, you could take on part-time work or diversify your income streams until your business consistently brings in the revenue you need. The goal is to grow your financial foundation in a way that allows you to run your business with confidence, rather than stress and uncertainty.

Preparing for Slow Months

As a business owner, you need to anticipate slow months before they happen. In other words, hope for the best, plan for the worst. The best way to do this is by having a solid financial plan in place. This includes:

Building an emergency fund to cover any income gaps during slow periods.

Planning your revenue-generating activities in advance so you’re not left scrambling for work.

Diversifying your income streams so you’re not relying on just one source of revenue.

By taking these steps proactively, you create a more stable financial foundation and reduce the stress of unpredictable income fluctuations.

Diversifying Your Income Streams

If you’re only offering one type of project—like full Squarespace website builds priced between $2,000 and $5,000—you’re setting yourself up for financial instability. A successful business typically has multiple revenue streams. In fact, many experts suggest having at least seven different income sources to create long-term sustainability.

Here’s how I’ve diversified my revenue as a Squarespace designer and business owner:

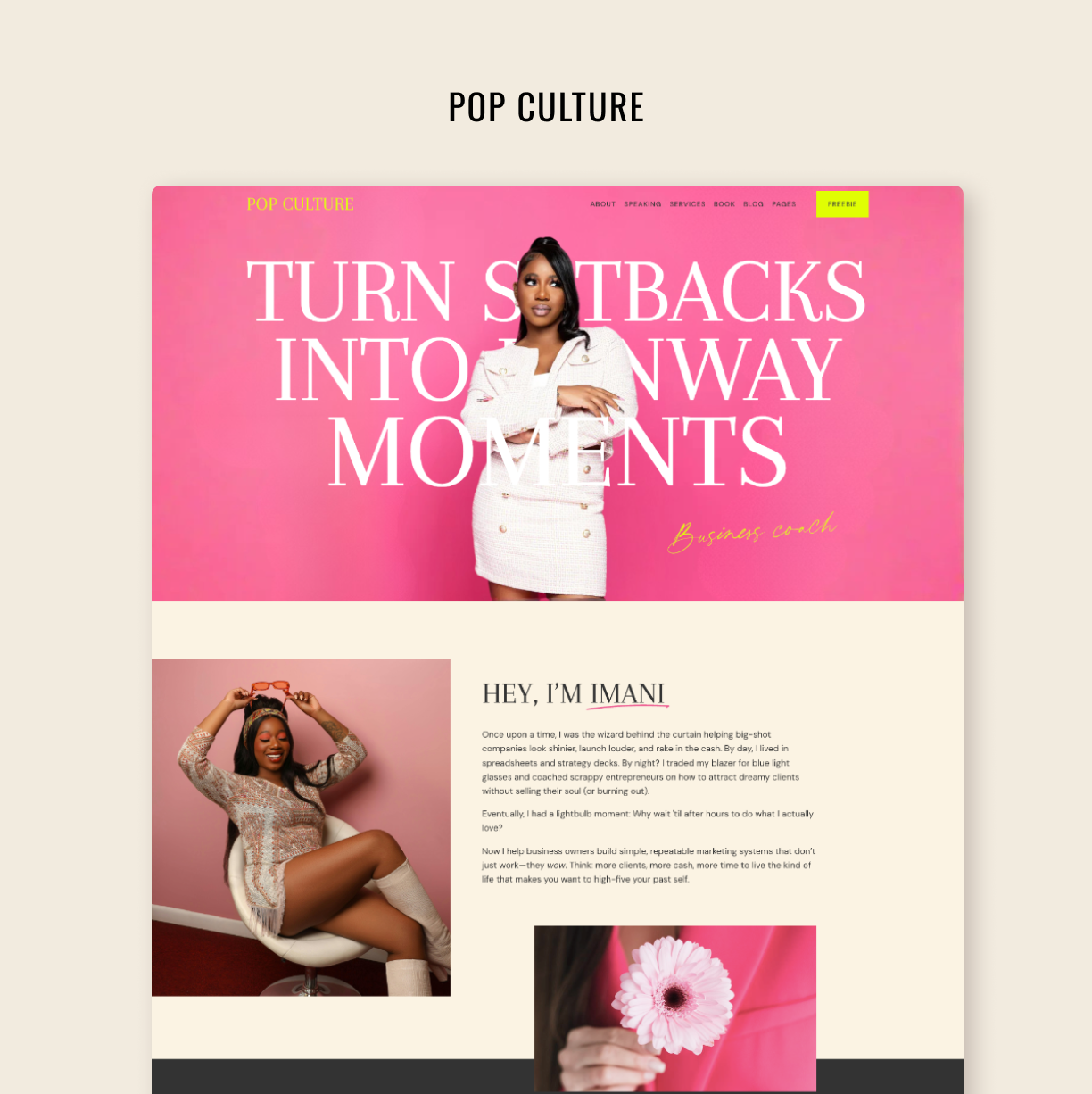

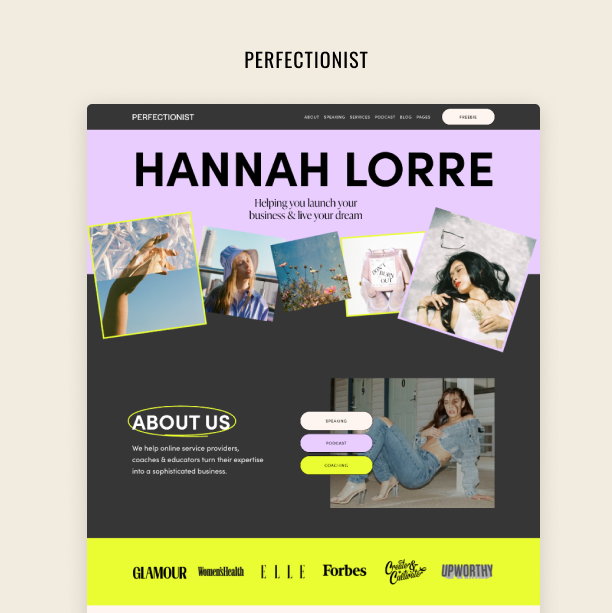

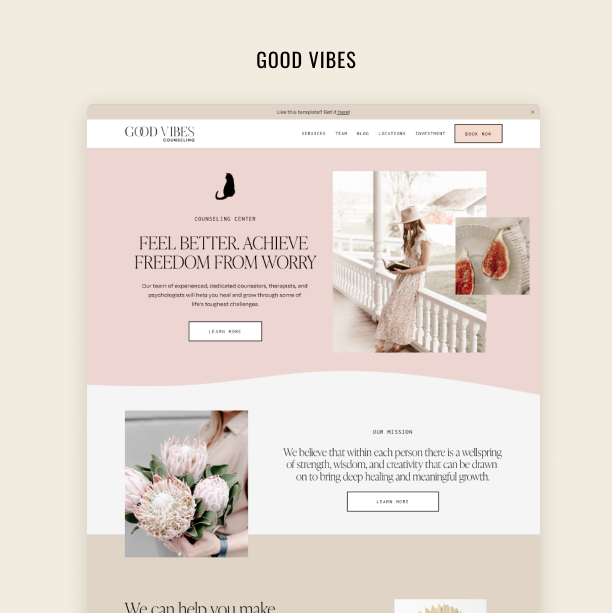

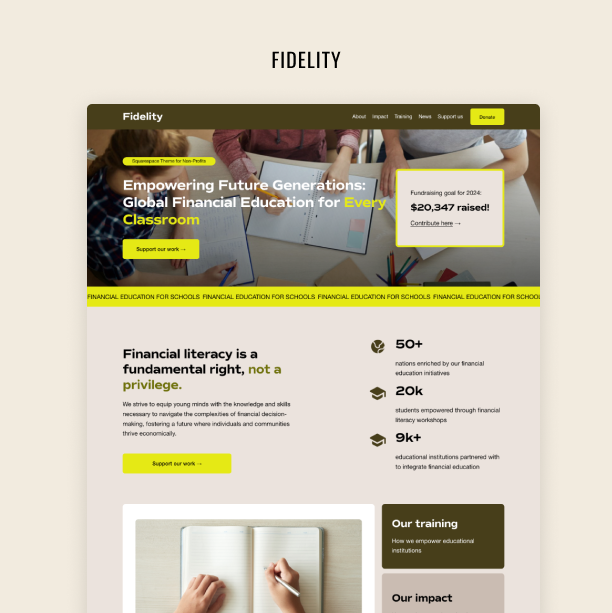

Squarespace Templates – Digital products that generate passive income.

Courses for Squarespace Designers & Creative Businesses – Teaching others the skills I’ve mastered.

Client Work – This is also diversified into:

Full Website Projects ($3,000–$7,500 on average)

Custom Consultations – One-hour or two-hour sessions covering specific client needs.

VIP Days – clients book my whole day to complete their projects or tasks.

Affiliate Marketing – My high-traffic blog not only brings in new clients but also generates affiliate revenue, covering most of my business expenses.

The key to diversification is understanding that different clients have different needs. Some may want a full website build, while others prefer a one-hour strategy session. By offering a mix of services—hourly consultations, smaller projects, full-service website design, and passive income streams—you create multiple ways for clients to work with you, increasing your overall revenue stability.

This diversification has given me financial security. Last year, when I had to take several months off, my business kept growing—even without me actively taking on new client work. This is when I experienced the true power of having multiple income streams.

Pricing for Profitability

To create financial stability in your business, price higher and always have multiple clients on payment plans.

Every time you take on a new project, price it slightly higher than your previous ones. This gradual increase helps you steadily grow your baseline, making your business more financially stable and profitable over time.

Ideally, you should have three to five active clients on payment schedules at any given time. This ensures a steady and predictable income rather than relying on sporadic lump-sum payments.

Another crucial strategy is introducing milestone payments early in the project. Never wait until the project is finished to send your next invoice. Instead, structure your payments so that clients pay in stages—such as an upfront deposit, a mid-project payment, and a final payment before launch. This not only creates a consistent cash flow but also keeps clients accountable and engaged throughout the project.

By overlapping projects and implementing milestone payments, you eliminate the financial rollercoaster that many freelancers experience, making it easier to plan, invest, and grow your business with confidence.

Protecting Your Income

Setting your business up for success means having systems in place that protect you from late payments, scope creep, and unnecessary headaches. One of the most important things you can do is have a strong contract that clearly defines your payment terms and project scope.

A key clause to include is that the payment schedule is independent of the project timeline. This means that even if a client delays submitting content, photos, or feedback, their payment schedule remains unchanged. You’re not waiting indefinitely for them to move forward—you’re still getting paid on time. This protects your cash flow and ensures that clients don’t drag out projects without consequence.

Your contract should also protect you from scope creep, that is when the number of tasks keeps on growing. You need to set clear boundaries on revisions, extra requests, and changes beyond the agreed-upon scope. A solid contract is only effective if you enforce it, so don’t be afraid to refer back to it when needed.

Finally, automate your contracts and invoices with tools like HoneyBook or Dubsado instead of handling them manually through email. Automating this process saves hours of administrative work and ensures a professional, seamless client experience. Running your business like a business—not a side hustle—starts with putting these protections in place from day one.

Scaling Your Design Business

"Scaling" has become a buzzword that’s thrown around so much that people have forgotten what it actually means. At its core, scaling simply means getting more of everything—more clients, more traffic, more revenue.

If you want to scale, you need more clients. To get more clients, you need more traffic. And to increase traffic, you have to invest in either paid ads or organic marketing efforts like blogging and SEO. That’s where outsourcing comes in. If you’re spending too much time on marketing instead of design work, scaling might mean hiring a freelancer or a team member to handle content marketing—producing more blog posts, social media content, and outreach—so you can focus on client projects.

Scaling can also mean expanding beyond Squarespace. By offering services on Shopify, Webflow, or Showit, you tap into new markets and increase your reach. Think about how restaurant chains scale—an independent restaurant has limited reach because it’s in one location, but a chain expands by opening multiple locations. You can apply the same concept to your business by launching more websites, creating more content, and even hiring additional designers to take on more client work.

At the end of the day, scaling isn’t a secret formula—it’s about systematically doing more of what’s already working. More content, more marketing, more service offerings. The result? More revenue.